The Complete 3-Tier Tax Strategy & Audit Defense System for College-Bound Families

Reduce five-figure tax liabilities without hours of spreadsheet drudgery.

Master the 7-Step Blueprint to Slash Capital Gains, Capture Every Education Credit, and Fail-Proof Your Audit Defense.

CLICK BELOW TO WATCH FIRST!

4.9/5 star reviews

Thousands of happy customers worldwide

AS SEEN ON

Stop Overpaying the IRS and Protect Your Family From Costly Audits

Does this sound like you?

Paying thousands in unnecessary capital-gain taxes.

Fear of triggering an audit due to missing documentation.

Confusion about which education credits or deductions you really qualify for.

Spending weekends wrestling with tax software and receipts.

Uncertainty about coordinating federal and California filings.

Plug our proven documentation framework directly into your existing workflow.

Claim every credit and deduction with CPA-verified confidence.

Use our secure portal to store receipts and auto-populate forms.

Invest only in the strategies that guarantee a positive ROI.

Relax knowing audit defense insurance and licensed CPAs have your back.

Here’s What Your Family Receives

Education Credit Maximizer

Identify every deductible education expense and choose the ideal filing status for maximum college savings.

Capital Gains Optimization

Apply capital-gain harvesting and income-shifting tactics that keep you in the 0–15% bracket.

Audit-Proof Documentation

Assemble bullet-proof digital documentation that satisfies both IRS and California substantiation rules.

Federal/State Harmony

Sync federal and state strategy so your numbers match and red flags disappear.

No-Code Automation Toolkit

Automate data collection with our plug-and-play no-code spreadsheets, portals, and e-signature flows.

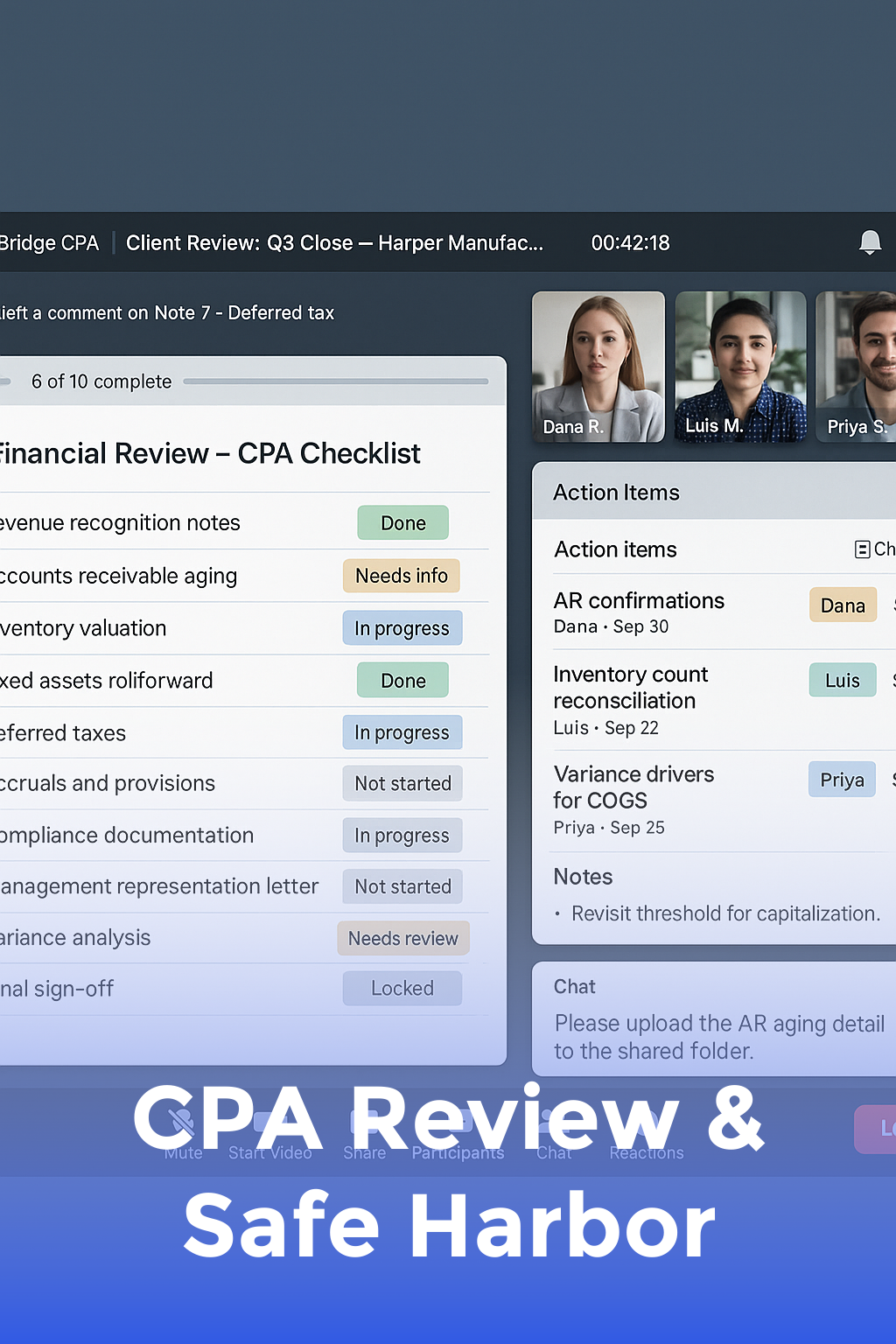

CPA Review & Safe Harbor

Leverage CPA review sessions and safe-harbor strategies to lock in compliance before filing.

TESTIMONIALS

What our students are saying...

" We saved $16,400 in capital-gain taxes last year and breezed through FAFSA with zero red flags. The templates alone were worth the price. "

- Karen & Michael Patel

" The DWY tier held our hand through every form. When the IRS asked for proof, we sent the PDF binder generated by the portal and the case closed in 3 days. "

- John Doe

" As a grad student with freelance income, I dreaded state compliance. The DFY team filed everything and my refund was 28% higher. "

- Roberta Johnson

MODULES

FOLLOW MY STEP BY STEP VIDEO TRAINING

Education Credit Maximizer

Identify every deductible education expense and choose the ideal filing status for maximum college savings.

Capital Gains Optimization

Apply capital-gain harvesting and income-shifting tactics that keep you in the 0–15% bracket.

Audit-Proof Documentation

Assemble bullet-proof digital documentation that satisfies both IRS and California substantiation rules.

Federal/State Harmony

Sync federal and state strategy so your numbers match and red flags disappear.

No-Code Automation Toolkit

Automate data collection with our plug-and-play no-code spreadsheets, portals, and e-signature flows.

CPA Review & Safe Harbor

Leverage CPA review sessions and safe-harbor strategies to lock in compliance before filing.

Audit Defense & Insurance

Activate audit defense insurance and understand exactly how claims and representation work.

Yearly Compliance Blueprint

Build your annual update checklist so next year's filing takes under 2 hours.

4.9/5 star reviews

Optimize Capital Gains, Maximize Education Credits, Bullet-Proof Your Audit File

Choose the DIY, DWY, or DFY path and let our CPA-led framework slash your tax bill while keeping you 100% IRS & California compliant.

Here's what you get:

Instant streaming access to 40+ bite-sized strategy videos.

Downloadable checklists, templates, and no-code automation sheets.

Secure client portal with real-time CPA Q&A and community forums.

Lifetime updates when tax laws and IRS guidelines change.

Today Just

$997 one time

"Best purchase ever!"

" The DWY tier held our hand through every form. When the IRS asked for proof, we sent the PDF binder generated by the portal and the case closed in 3 days. "

ABOUT YOUR INSTRUCTOR

Meet Wynn

Your instructor is a licensed CPA and former Big-4 auditor who has spent 18+ years guiding high-net-worth families through complex federal and state tax landscapes. After helping his own children navigate college costs, he specialized in tax strategies that turn tuition expenses into savings opportunities.

He noticed that even affluent, financially savvy families leave thousands on the table and keep incomplete records—issues that can trigger brutal audits. By merging no-code automation with CPA oversight, he built this three-level system so any family can achieve airtight compliance without drowning in paperwork.

Our members routinely cut four- and five-figure tax bills, receive clean IRS acceptance letters, and report total peace of mind knowing every receipt, form, and workflow is CPA-approved and insurance-backed.

Managed over $500M in client assets with zero audit losses.

Featured tax expert on CNBC, Kiplinger, and Forbes.

Authored the #1 Amazon bestseller "Tax-Smart College Funding".

Creator of the highest-rated parental tax strategy program (4.9/5 stars).

Secured $20M+ in education-related tax savings for clients.

Developed proprietary audit-proof documentation software adopted by 150+ firms.

WHO IS THIS FOR...

For parents and graduate students who want to legally reduce taxes, document every deduction, and sleep well during audit season.

Parents funding undergraduate tuition

Graduate students with side-income

High-income families realizing capital gains

529 or UTMA account holders

Real-estate investors with dependents in college

Tech employees receiving RSUs

Self-employed professionals seeking audit protection

First-time filers navigating state compliance

STILL NOT SURE?

Satisfaction guaranteed

We want you to find value in our trainings! We offer full refunds within 30 days. With all of our valuable video training, we are confident you WILL love it!

STILL GOT QUESTIONS?

Frequently Asked Questions

Will this help with both federal and California state returns?

Absolutely. Each module includes step-by-step guidance and pre-built forms for aligning your 1040 with CA Form 540 and Schedule CA so numbers reconcile perfectly.

Do I need prior tax knowledge?

No. The DIY tier starts with the basics, while DWY and DFY tiers add personalized CPA sessions. If you can upload a receipt, you can follow the system.

How is this different from hiring a traditional CPA once a year?

Traditional firms file what you give them. We give you the strategy, automation tools, insurance, and year-round access—plus white-glove execution at the DFY level—to prevent problems before they start.

Enroll in the course now!

Copyrights 2024 | College Tax Armor™ | Terms & Conditions